scaling is hard

i have been, err, "working" on sports betting models with my son for fun.

and now you get to hear a trading analogy about it.

sports betting is expensive.

the noise bettor incinerates money faster and more efficiently than the trader.

but, it turns out, it's quite easy to find edge if you have the right kind of ideas.

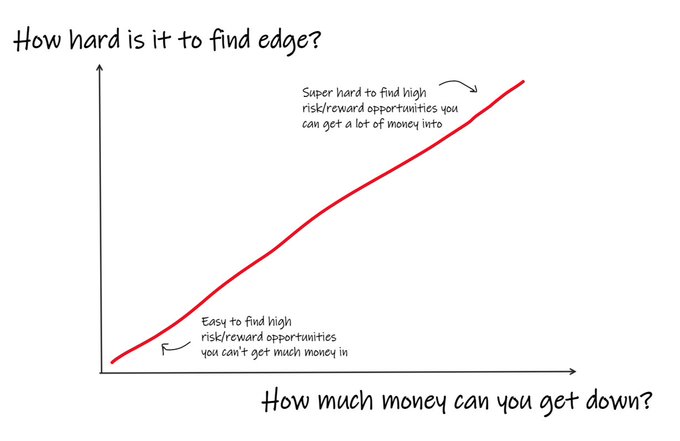

the challenge is, it's hard to get enough money down to make it worthwhile.

- you can have mispriced markets that you can't get much money in.

- or you can have very efficient markets you can get a lot of money into.

you probably can't have both.

so, you say:

- big markets are hard

- little markets are easier, but i can't get much money in them...

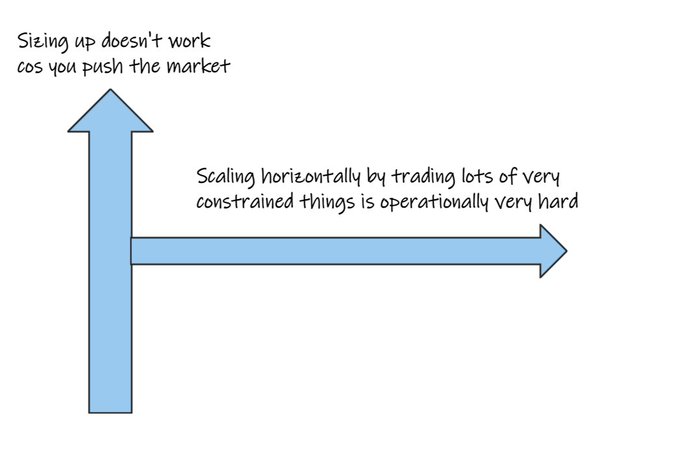

...why don't i scale horizontally?

why don't i find lots of little constrained markets and trade lots of them, then i can scale effectively.

and the answer to that is that everything is way more work than you want it to be.

jobs, jobs, jobs everywhere. everything is a bit different. things need oversight. things fall apart. things blow up. things need tweaking.

lots of jobs to keep the wheels on the road.

and, indeed, the reason these very small markets are inefficient is that it's uneconomic for anyone to harness them.

scaling horizontally like this is hard for everyone and normal economies of scale don't help much.

so, in the real world, if you have a lot of money to put to work, some horizontal scaling will help, but ultimately you're going to have to have to compete much harder and accept much more variance in outcomes than if you have a small amount of money to put to work.

the journey of the quantitively-inclined trader is similar.

if you are good with data analysis, it is quite easy to find a lot of things that look like really high risk/reward edge in past data.

but in practice, it doesn't work with real money, cos you weren't in that data.

once you get over the more obvious simulation problems, you might find that it's fairly easy to make really good % returns trading 1 lots in small markets.

but you soon find that it falls apart quick when you try to size up.

because, every time you trade, you're pushing price away a little bit, or holding it up a little bit.

you're pushing price away from you, closing the pricing inefficiencies you are trying to exploit.

and you start to realize that really juicy opportunities only looked that way cos you can't get much money in them.

so, you're faced with the same trade-offs.

if you can't scale up, can you scale out horizontally?

can you find lots of similarly constrained super-high risk/reward opportunities and do lots of them, small in each?

well, not easily.. cos everything is a lot of annoying parochial effort.

(and if it wasn't, the opportunity wouldn't exist.)

now, maybe there is an opportunity for someone to come and leverage modern technology (chatgpt etc) or very cheap labour to somehow go after some of this stuff at scale...

i think this will happen a bit, but hard things are aways hard.

in the real world, trade-offs exist.

you can find high risk/reward opportunities you can't get much money in.

those opportunities, whilst "easy" on the scale of things, are not "easy" enough it's a slam dunk to scale lots of them horizontally.

ultimately, to compete at meaningful size, you need to be able to:

- accept more variance, or

- invest a ton in infrastructure and people and training and...

probably the first one, eh?

so, what's the good news?

well, there's not any really. you can't have your cake and eat it.

but know that, inside all of us is a compassionate light that wants to love and be loved, and that the more you can surrender to it, the happier you will be. or something.

beep...boop.