why did price move after an announcement that was in-line with expectations?

question from friend in twitter dm

"price moved big after an announcement that was expected; doesn't that mean the market hadn't priced it in right?"

no. not necessarily.

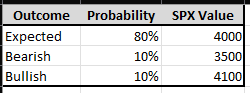

let's simplify to 3 possible outcomes.

and let's pretend we can know the probability of it happening and what SPX would be worth in each case:

- expected (80% chance) - SPX worth $4000

- bearish (10% chance) - SPX worth $3500

- bullish (10% chance) - SPX worth $4100

given this, where should SPX be trading right now?

it should be trading at the price at which we wouldn't be expected to make any money long or short.

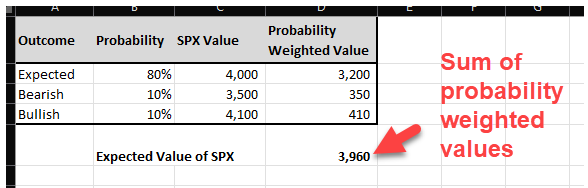

this is the expected value of SPX, which we calculate as the sum of (probability * SPX value) for all outcomes.

so, SPX should be trading at $3,960

which is *below* the fair value of SPX if the expected outcome realizes.

if we get the outcome everyone expects, then the price should go up - in this case.

that's not a mispricing. that's rational market re-pricing based on realized outcomes.

why?

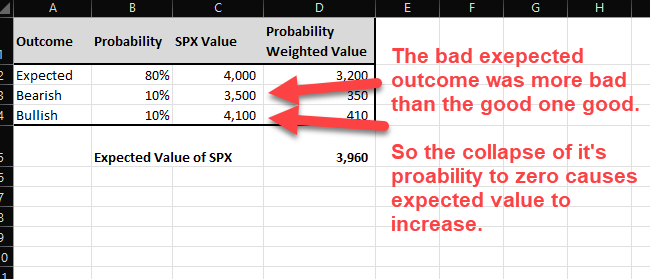

cos the bearish expected outcome was worse than the bullish outcome was good.

the collapse of the bearish probability to 0% causes our expectation to increase.

this is quite common.

the non-realization of very bad outcomes often causes price appreciation in the mundane, expected case.

beep...boop